Co-authored by the Organisation for Economic Co-operation and Development (OECD) and the Food and Agriculture Organization of the United Nations (FAO), the report “Agricultural Outlook 2023-2032” provides insights into the landscape of regional, national, and global agricultural markets by the year 2032. The outlook is based on the expertise of both aforementioned organizations and the data provided by member countries or professional representations such as the World Association of Beet and Sugarcane Growers, the International Cotton Advisory Committee, the International Grains Council, the International Fertilizer Industry Association, the International Dairy Federation, The Marine Ingredients Organisation (IFFO), and the International Sugar Organization (ISO).

The report indicates that commodity prices are expected to return to more acceptable levels, largely driven by improved productivity but subject to climate-related risks.

This projection of agricultural, fishing, and aquaculture markets takes into account economic, energy, and climate uncertainties. Agricultural inputs are becoming increasingly expensive and hinder the goal of food security. A 1% increase in fertilizer prices results in a 0.2% increase in food prices, a phenomenon more pronounced in crops than in livestock. Additionally, other resources such as energy, labor, and equipment are also impacted.

In this latest edition, consumption estimates have been refined to account for issues of food losses and waste highlighted in SDG 12.3, which aims to reduce food losses by 50% by 2030.

Experts have also revised the growth forecasts downward and expect a slow increase in energy costs until 2032.

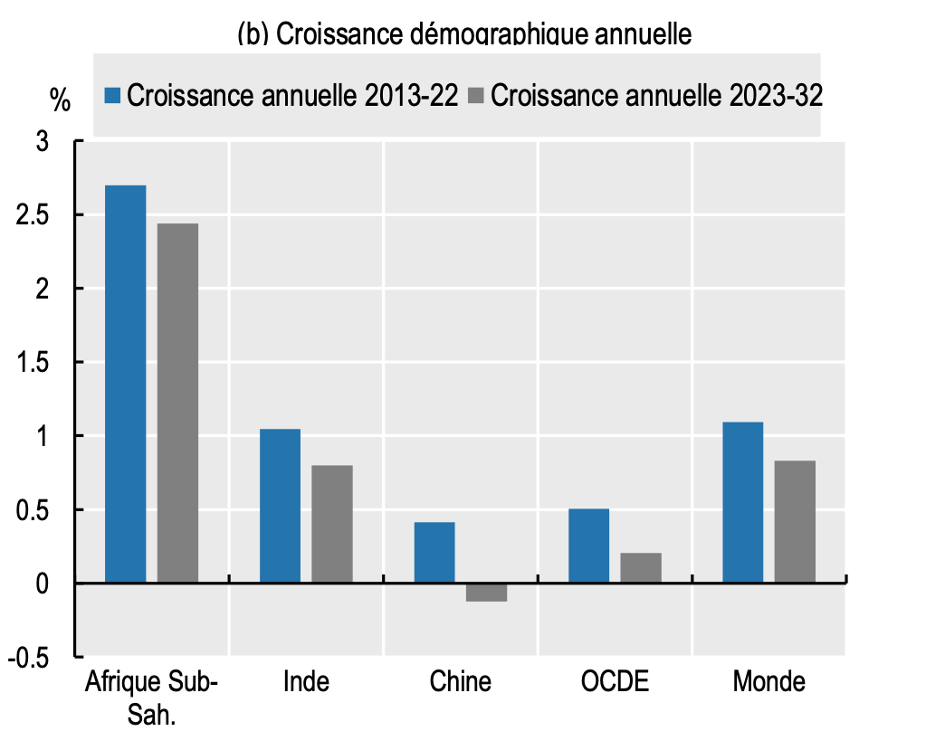

As for consumption, it is expected to increase with population growth but at a pace constrained by declining purchasing power. The consumption of animal feed is expected to rise in low-income countries that practice livestock farming, especially in aquaculture.

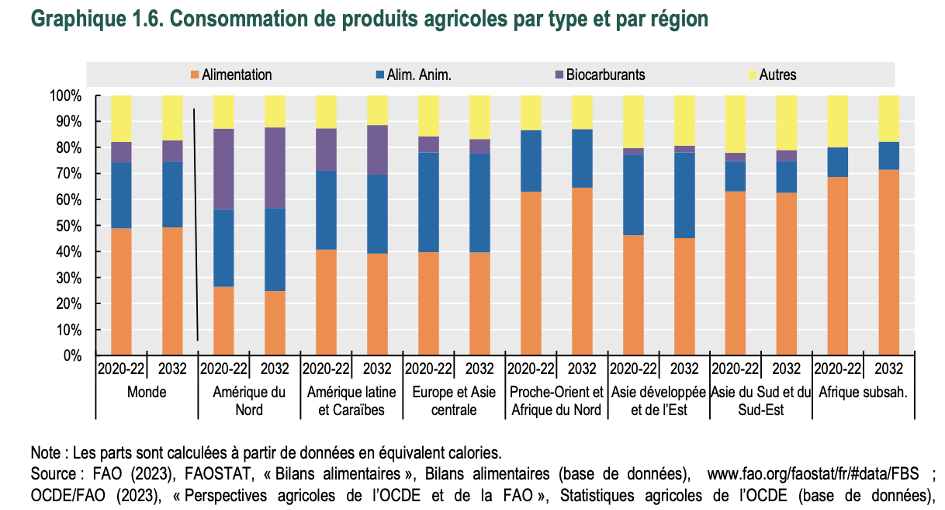

Biofuels are projected to increase in India and Indonesia due to higher energy needs combined with the requirement to integrate a share of biofuels in usage. In contrast, in the European market, the overall decline in fuel consumption should also reduce the demand for biofuels. Sugarcane and vegetable oil appear to be the preferred raw materials for biofuel production.

Facing stagnant agricultural investments, global agricultural production is expected to grow by 1.1% per year, particularly in the poorest countries, which will also experience a simultaneous increase in input prices, leading to persistent risks of inflation and famines.

Agricultural stakeholders anticipate improved plant productivity, with a risk of transitioning to intensive cropping systems. Increased yields will account for 4/5 of the rise in plant production, far surpassing the expansion of cultivation areas.

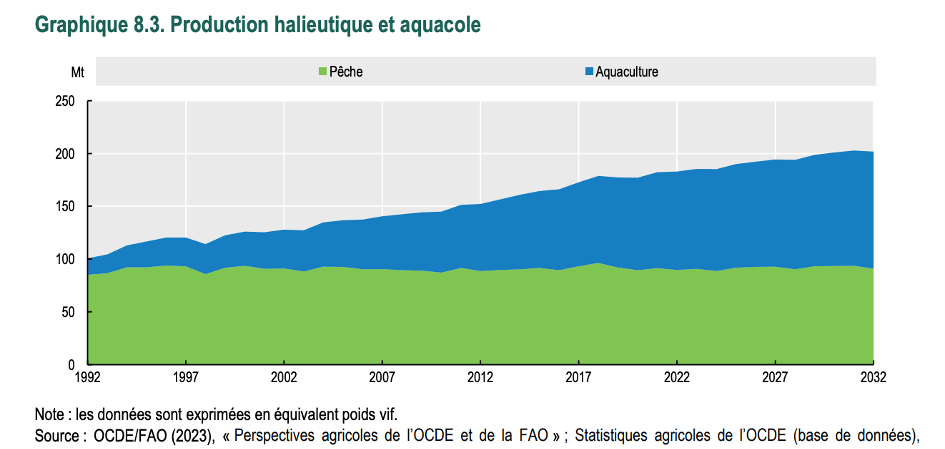

Livestock productivity will be improved through better management of herds and aquaculture populations, and increased purchases for animal feed. This trend will be primarily driven by the poultry sector, followed by the pig industry, which has not yet regained its pace since the outbreak of swine fever. Aquaculture will continue its growth, with its volume doubling that of traditional fishing.

Although greenhouse gas emissions will increase at a slower pace than agricultural production, efforts must still be made to transform the agricultural model and make it a sustainable transition lever in line with the expectations of the Paris Agreements. The transition to sustainable agriculture is even more challenging as the sector faces extreme climate events (rainfall or drought) and the need to produce in sufficient quantities.

In case of shortages, markets can rely on multilateral trade agreements to compensate for scarcities and improve the food security of states. International organizations emphasize the negative effects of flow restrictions on prices, but states also aim to protect their sovereignty.

The authors of the report provide perspectives based on the preservation of political contexts, consumption trends, and technologies.

Fighting losses and waste, a lever for food security

The constrained environment of the agri-food sector is expected to result in a slowdown in markets, due to the increased cost of inputs, climate change, environmental regulations, and a decrease in household purchasing power.

Source: OECD and FAO Agricultural Outlook Report 2023-2032

Reference prices for staple commodities are expected to decrease slightly, but the impact on consumer prices is difficult to predict. Consumption disparities are observed among countries, preferences, and income levels. Consumption patterns may also be affected by rapid urbanization in emerging countries.

For households whose food expenditure represents a significant portion of their budget or whose food choices are based on traditions, the impact will be more pronounced.

Human consumption of food remains predominant, but there is a trend towards an increase in the share of commodities reserved for animal feed or biofuel production. Currently, about one-third of agricultural production is destined for animal feed, and nearly one-tenth is used for biofuel production. If the intensification of livestock farming continues, the share of food commodities reserved for animal feed is expected to further increase in the next decade.

Source: OECD and FAO Agricultural Outlook Report 2023-2032

The African continent deviates from the trend, as the share of food commodities used for human consumption remains significant and is expected to be confirmed within the next ten years.

Studying innovative practices to reduce losses related to food waste at all levels of the supply chain is crucial, as losses are estimated at 14% during harvesting, transportation, and distribution stages, and then 17% during the commercialization phase and consumer consumption.

Food Commodities: Assessment and Outlook by Type

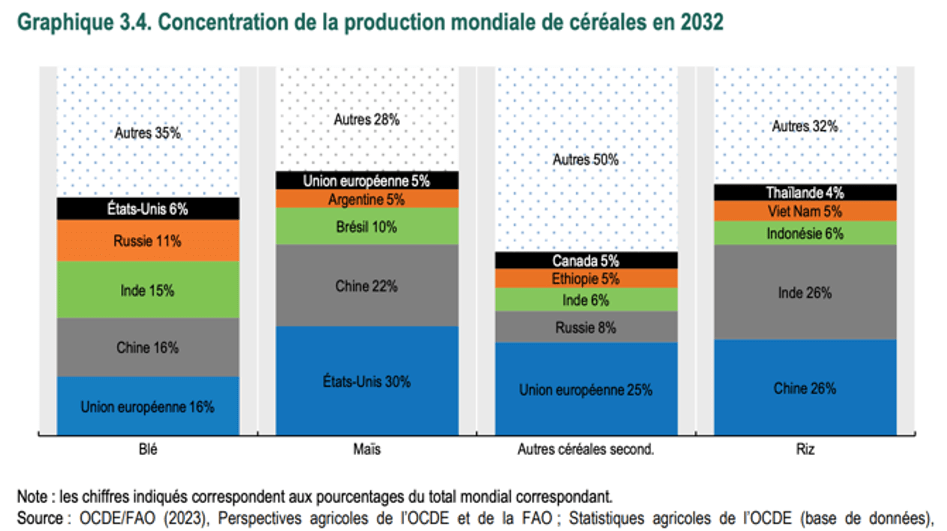

Regarding cereals, wheat production is increasing, and the Black Sea cereal agreement helped curb the price peak observed in early 2022. Corn remains underproduced, while rice maintains a high price despite overproduction.

Asia is expected to contribute to the increasing demand for cereals, both for human consumption and animal feed. Technological transitions will improve crop monitoring and yields. Cereal trade will continue but with a different geographical distribution.

Source: OECD and FAO Agricultural Outlook Report 2023-2032

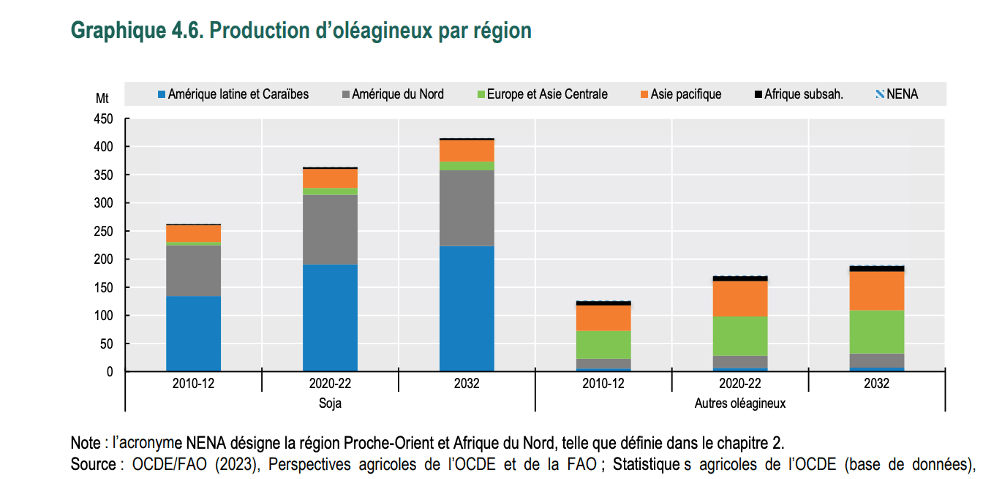

The prices of oilseeds are also starting to decline, mainly due to the recovery in soybean and rapeseed production, but they have not yet returned to their previous levels. The increase in palm oil exports by Indonesia and Malaysia has led to a decline in vegetable oil prices.

The demand for vegetable oil will remain a dynamic lever in the oilseed market, but its growth is expected to slow down, estimated at 0.1% per year, far behind the 0.8% seen in previous years. The decline in food demand from developed countries explains this trend.

Soybean production is concentrated in the Latin American region, and oilseed trade will slow down influenced by environmental concerns.

High prices are expected to decrease in the next decade.

Source: OECD and FAO Agricultural Outlook Report 2023-2032

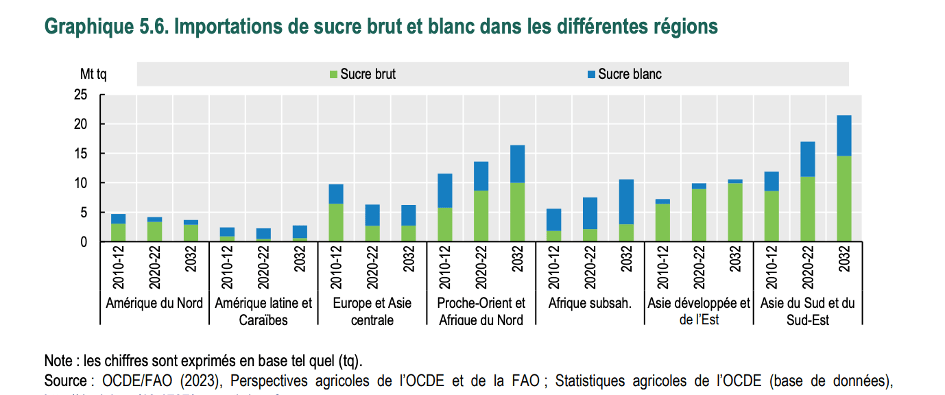

While sugar will experience a slowdown in demand due to the economic growth slowdown, the increase in input costs will limit the decrease in its price.

Consumption will grow slightly, driven by demand from emerging countries, while consumers in industrialized countries plan to reduce their consumption for health reasons. The annual growth rate is expected to be around 1.1% with a global production of 193 million tonnes by 2032.

Corn syrup, another sweetener used in beverages, will grow slowly, as its liquid form complicates trading. The main producers and consumers are the United States and Mexico, with a consumption of 13.7 and 9.2 kg per capita in 2032, respectively.

Sugarcane remains the main sugar crop, accounting for 9/10th of sugar crops and producing 1,905 million tonnes by 2032.

Due to a surplus in the global market and Brazil’s energy policy favoring sugar over ethanol in biofuel production, prices are expected to remain stable despite the demand slowdown.

Source: OECD and FAO Agricultural Outlook Report 2023-2032

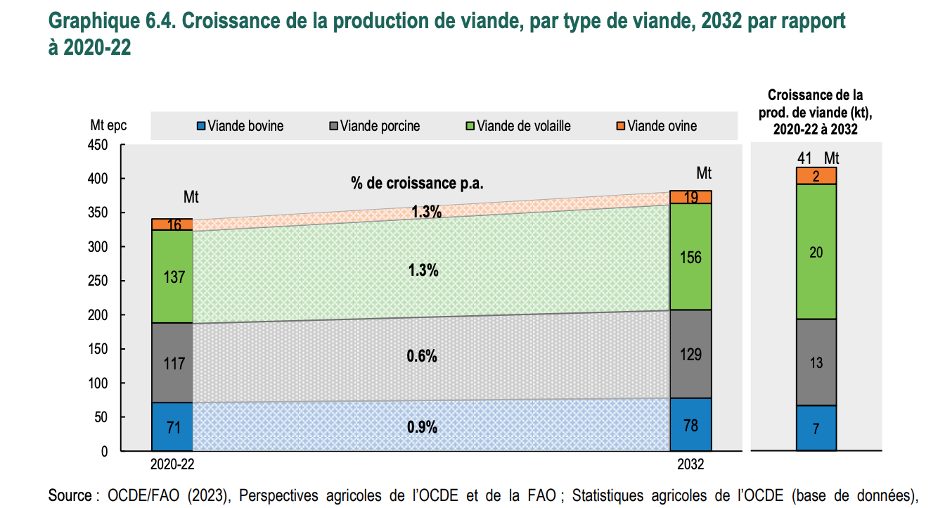

Apart from sheep production, which saw a price decrease due to a decline in Chinese demand, the price of meat remained high, mainly due to diseases, the cost of animal feed, and extreme droughts that hindered livestock productivity. The meat market is mainly stimulated by Asia, with the recovery of its pig farming.

Inflation affects demand. Trade will grow moderately as importing countries work on localizing supplies. Productivity gains are also expected to keep prices down.

The outlook remains subject to the threats of animal diseases that weigh on this sector and a possible drop in demand depending on the income growth of emerging countries. Indeed, it is with an increase in the income of poor households that meat products are consumed. For affluent households, consumption varies depending on income but also on an ideology related to environmental concerns.

Source: OECD and FAO Agricultural Outlook Report 2023-2032

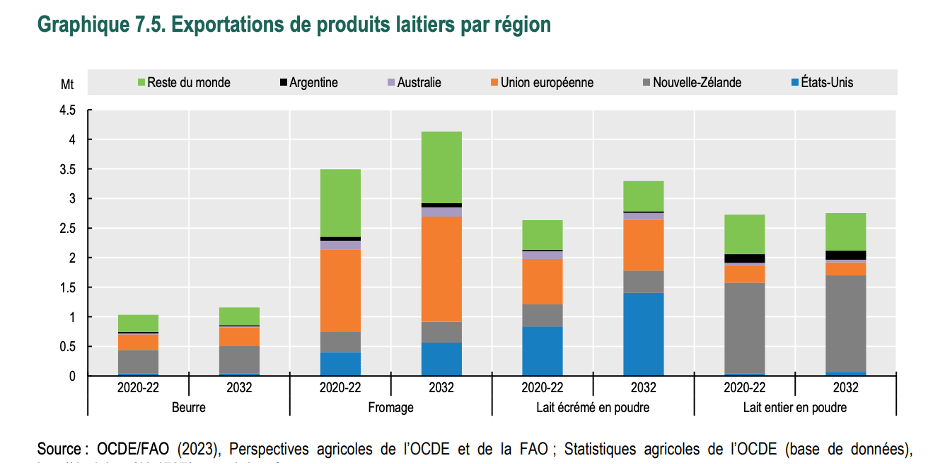

Dairy products saw their prices surge in 2022 due to the rising cost of inputs and one of the lowest global production growth rates of the century. Additionally, there was a decline in Asian demand.

However, demand from India and Pakistan is expected to support consumption levels and reward improved productivity.

Trade is dominated by a few large exporters facing numerous small importers. This configuration explains the high price volatility, with only 7% of global dairy production being traded internationally. The challenges in transporting this commodity contribute to limited international trade. Dairy production is mostly consumed domestically, leading to detachment from international prices.

The term “dairy products” refers to processed items such as butter and skimmed milk powder. Their prices are expected to slightly decrease in the coming decade.

Source: OECD-FAO Agricultural Outlook 2023-2032 Report

Fish consumption is increasing while production is growing at a slow pace. Prices remain high, approaching the record levels of the 1990s, supported by production costs and growing demand.

For the next decade, production is expected to be primarily directed towards human consumption (90%), with a decrease in the portion reserved for fishmeal and fish oil production. The El Niño phenomenon will impact resource availability and focus production on human needs.

The rise in demand will mainly occur in high-income countries.

The decrease in usage for animal feed will drive the demand for oilseed meals, with a consumption volume of approximately 11 million tonnes in 2032.

Aquaculture will play a significant role in supporting the production level.

Source: OECD and FAO Agricultural Outlook 2023-2032 Report

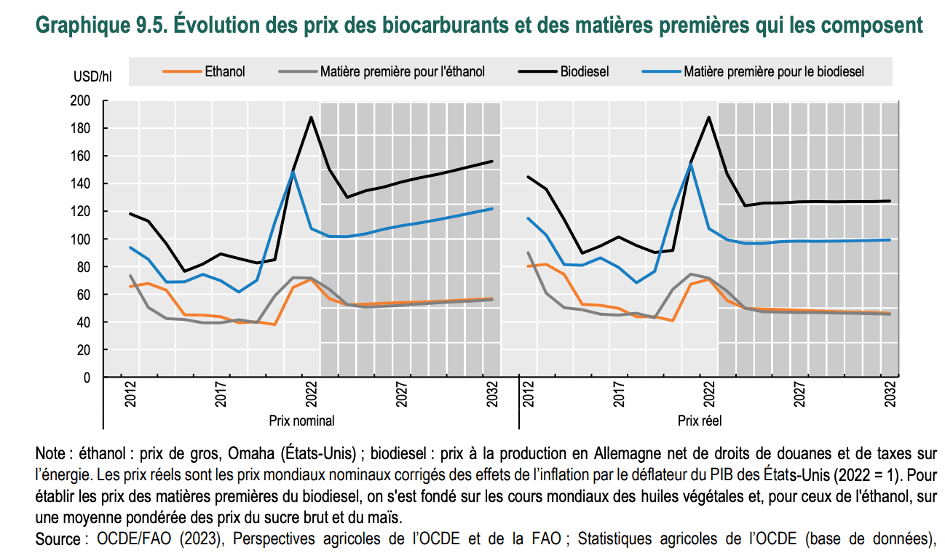

The high consumption of biofuels maintains a high price level, and this is further exacerbated by the increase in the cost of raw materials used in the production process.

Projections for this sector are greatly influenced by the energy policies of each country, and Asian countries continue to have a significant impact on the supply and demand of biofuels.

Major exporters of biodiesel include China, the European Union, Argentina, the United States, and Malaysia, with Argentina expected to reach the second position ahead of the European Union.

After record prices in 2021, biofuels are expected to experience a real price stagnation or even a decrease, as consumption stabilizes.

Source: OECD-FAO Agricultural Outlook Report 2023-2032

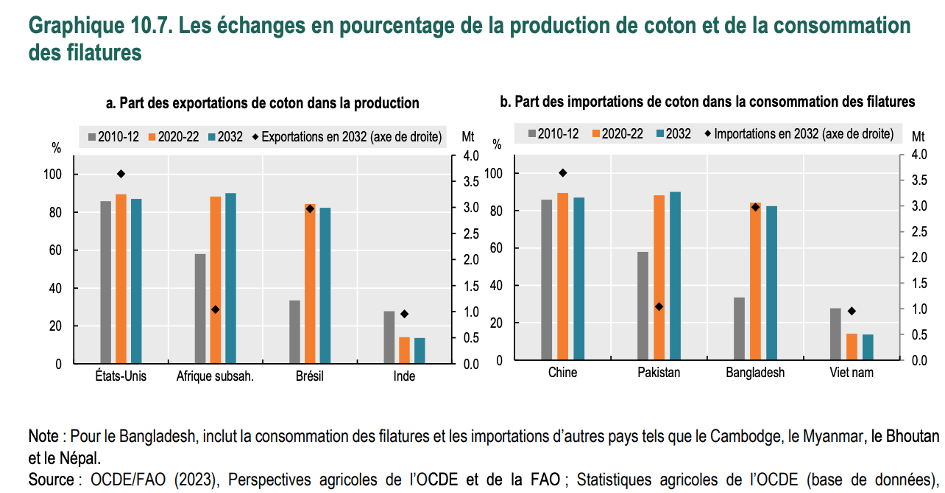

The cotton industry is experiencing a decline in demand from the textile sector.

The depreciation of currencies in cotton-producing countries against the dollar hampers gains. Prices have decreased, and production is declining, with the United States and Pakistan leading the trend.

On the consumption side, Vietnam and Bangladesh are driving the demand, surpassing China.

The market is characterized by a significant share of trade that will continue, and prices are expected to decrease, mainly due to the increasing share of synthetic fibers.

Source: OECD and FAO Agricultural Outlook Report 2023-2032

The agricultural sector bears significant responsibility for the economic and social stability of nations. It ensures food security, influences environmental transition goals, provides opportunities for the inclusion of women and children in the economic system, and contributes to the overall quality of life and health of populations.

Source : FAO